uber eats tax calculator canada

The following table provides the GST and HST provincial rates since July 1 2010. This sucks not only can I not put rent but.

Uber Eats Brings Bill Splitting To Deliveries Wilson S Media

You simply take out 153 percent of your income and pay it towards this tax.

/images/2019/09/23/ultimate_guide_to_earning_money_as_a_delivery-partner_with_uber_eats.jpg)

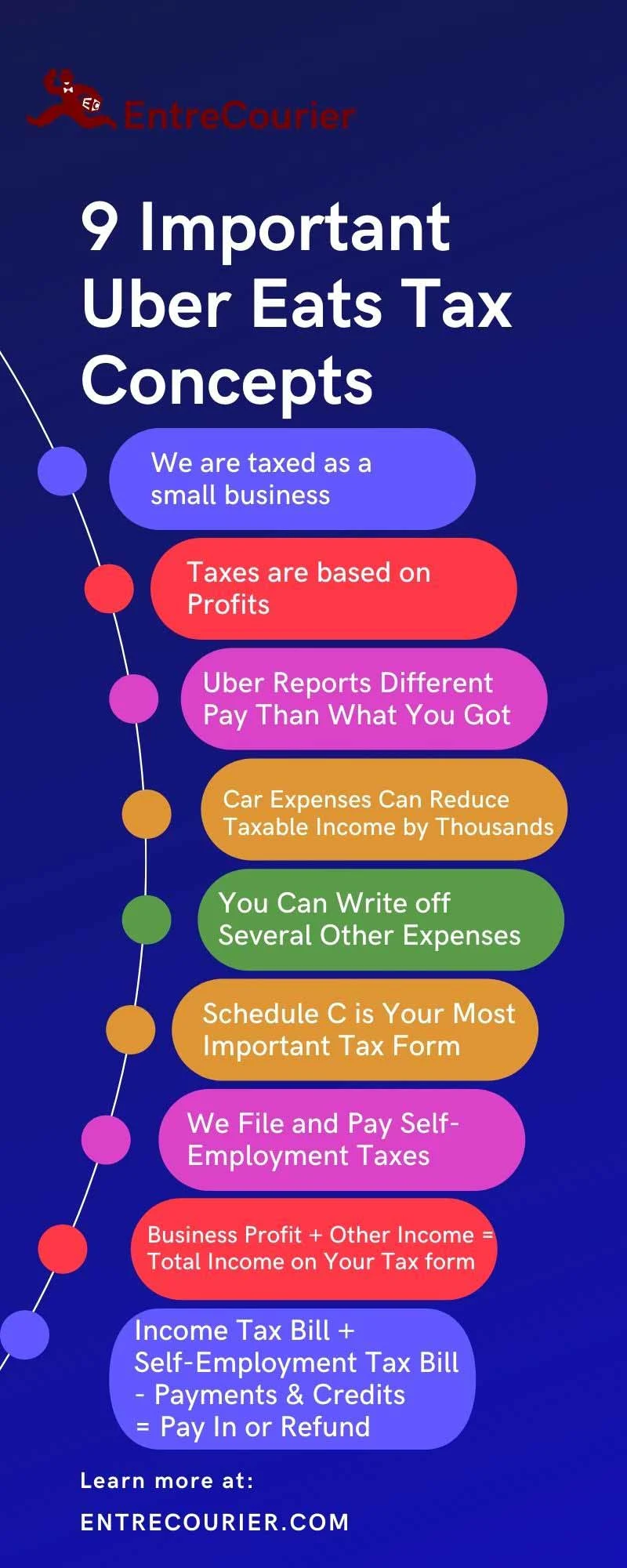

. Here are the 9 important concepts you need to know about taxes as an Uber Eats delivery contractor. For example if your taxable income after deductions is 35000 you will pay 5355 in self-employment taxes. Hi where can I input Uber Eats Tax Summary items such as On TripMileage when use BIKE no motor vehicle was used Gross Uber Eats fare Tips Incentives and UberEats service fee for filing Tax in Ontario CanadaLooking to hearing soon pleaseThank you.

Introduction to Income Taxes for Ride-Sharing Drivers. Get 12 9 mile order every 30 minutes. I got my ABN as individualsole trader in February 2020.

I did uber eats for only 1 month then i started uber eats delivery from october 2019 to till now on car. It only takes a few minutes to register online and youll have your GSTHST number instantly. Uber operates a technology platform that allows users to obtain and pay for on-demand transportation and logistics services provided by an independent contracted driver through an application for use on.

We are taxed as small business owners. Order food online or. Therefore you might receive a 1099-K for amounts that are below 20000.

Select your preferred language. Regardless of whether the driver earns at least 100000 in revenue per year or if it is deemed to be a small supplier by CRA a driver can still get a license. Using our Uber driver tax calculator is easy.

Now how should i link my ABN to uber eats account. As a Canadian youre required by the Canada Revenue Agency CRA to file income taxes every year. The Canada Revenue Agency requires every ridesharing driver to create a GSTHST account number which must be shared with Uber within 30 days of a first trip.

GSTHST on Food Delivery. For example if your taxable income after deductions is 35000 you will pay 5355 in self-employment taxes. Break for 5 hours.

Make 100 in 10 hours of work. This applies to earnings on both Uber rides and Uber Eats. Where the supply is made learn about the place of supply rules.

Your car expenses can reduce your taxable income by thousands. Arabic Azərbaycan Bahasa Indonesia Bahasa Melayu Čeština Dansk Dari Deutsch Deutsch Austria Eesti Keel English English British Español Español España Français Français Canada Hrvatski Hungarian Italiano ಕನನಡ Lietuvių Nederlands Norsk Bokmål Pashto Polski Português Brasil Português Portugal Pусский Română. The rate you will charge depends on different factors see.

Your average number of rides per hour. Normally your income tax is automatically deducted from the earnings you make throughout the year and summarized in a T4 slip thats issued to you by your employer. In Canada when you drive with Uber you are considered self-employed or an.

Once the income passes the 30000 the driver has to register for a GSTHST QST in Quebec account even for zero-rated. Certain states have implemented lower reporting thresholds. Sales tax breakdown.

2- How they come to 1163640. Work another 5 hours. HST on Uber rides 1163640.

Prepare a self-employed income tax return steps 1. Type of supply learn about what supplies are taxable or not. The average number of hours you drive per week.

The city and state where you drive for work. The provincial tax rate is 5. If your total income before deducting expenses is less than 30000 you will be referred to as a small supplier and you are not required to register for a business number or GSTHST account.

The 124 percent of this tax is for Social Security and the rest 29 percent is for Medicare. The self-employment tax is very easy to calculate. Now out of these total information I want to know 1- that my HST which 1163640 is included in the Gross uber rides or not.

What Uber Eats paid you and what they say they paid you are two different numbers. Uber Eats Tax Calculator Canada. In accordance with the rules and regulations outlined by the Canada Revenue Agency CRA Uber drivers Uber Eats Lyft Skip the dishes or other ride-sharing drivers are self-employed and are required to file their Canadian income taxes as being self-employedThat means that in addition to the usual income tax.

If you want to get extra fancy you can use advanced filters which will allow you to input. Sit outside Starbucks in the morning get 1 6 4 mile order every 45 minutes. Who the supply is made to to learn about who may not pay the GSTHST.

Follow the step-by-step instructions to register. Learn more on irsgov. Uber Eats Taxes are based on profits.

In accordance with the rules and regulations outlined by the Canada Revenue Agency CRA Uber drivers Uber Eats Lyft Skip the dishes or other ride-sharing drivers are self. Make 35 in 5 hours. Uber rdies service fee 1811873.

Your 1099-K is an official IRS tax document that includes a breakdown of your annual on-trip gross earnings. The average number of hours you drive per week. When i registered for uber eats on may 2019 they didnt ask ABN.

Unlike rides with Uber drivers who earn with Uber Eats are only obligated to register collect and remit sales tax from the moment they reach 30000 of revenue. The local tax rate in Ontario is 13. Well send you a 1099-K if.

Create an accountYou need to create a tax profile after your initial one has been processedCompleting the Income Information is Step 3Form T2125 should be completed in step 4Review the Bottom Line as part of Step 5The next time I go shopping let me tell you what a great experience it was. I opened my account on bicycle. All you need is the following information.

Every UBER driver must register with the Canada Revenue Agency and provide the agency with an HSTGST number. According to my Uber Tax Summary I earned 26300 driving with Uber Eats in 2019 but I didnt get a 1099-K. You are responsible to collect remit and file sales tax on all your ridesharing trips to the Canada Revenue Agency CRA.

Proof That You Can Make 900 1400 Wk With Uber Eats Alone I M Only 20 So I Can T Drive People Around I Don T Want To Either R Uberdrivers

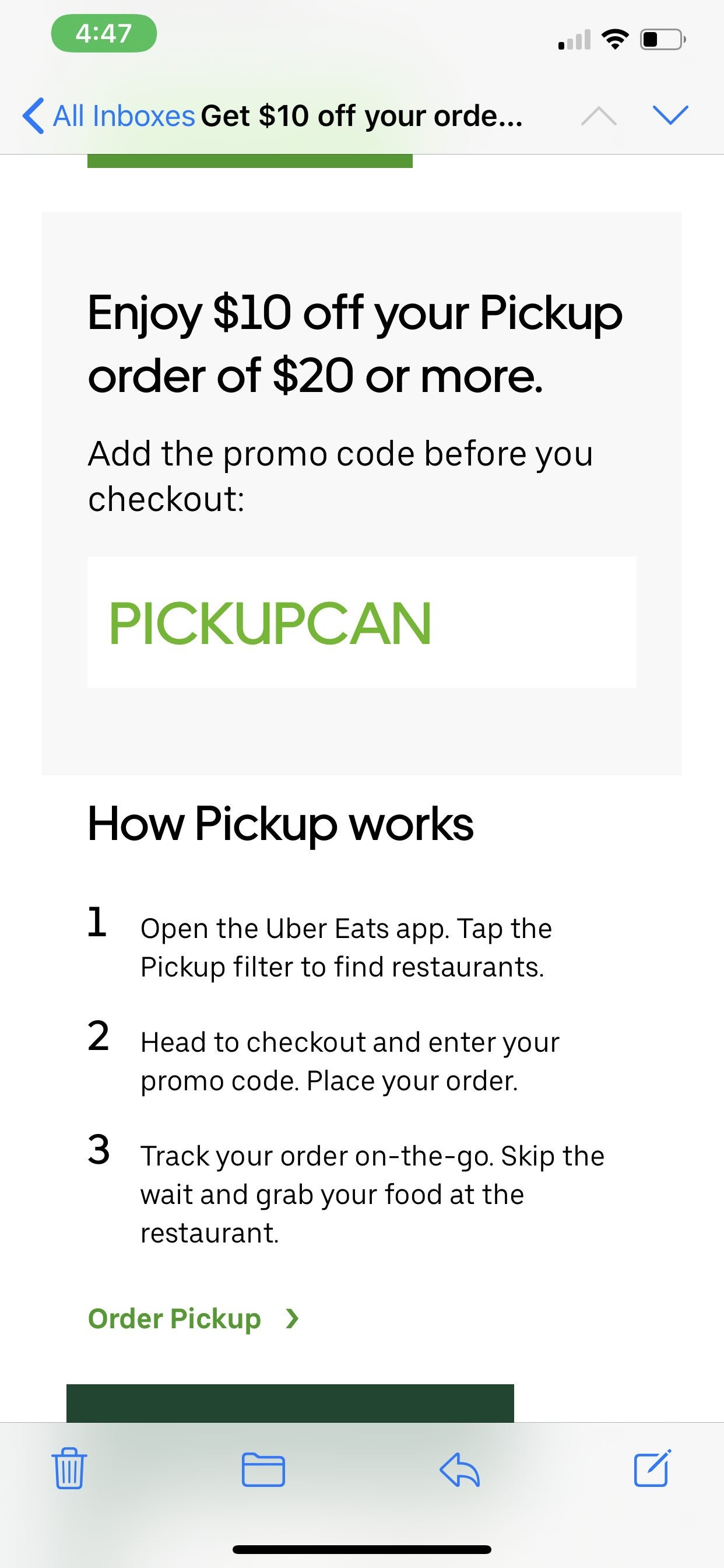

Uber Eats Get 10 Off Your Order When You Try Uber Eats Pickup Possible Ymmv Redflagdeals Com Forums

Uber Eats Driver Pay Calculator For Canada And Usa

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/15972766/IMG_4316.jpg)

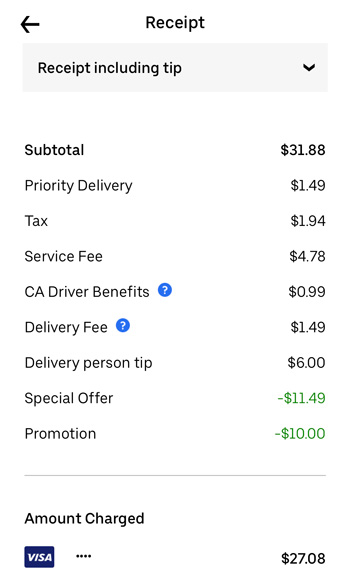

Uber Eats Rolls Out Confusing New Fees Here S What They Mean The Verge

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

How Much Do Uber Eats Drivers Make In 2022 Gobankingrates

Uber Eats 20 Gift Card Email Delivery Newegg Com

9 Concepts You Must Know To Understand Uber Eats Taxes Complete Guide

Ubereats Requirements Seattle Guide To Car Requirements And Pay Seattle Map Seattle Delivery Driver

How Much Does Uber Eats Cost And Learn How To Save On Orders Ridesharing Driver

How To Report Income From Uber In A Canadian Tax Return Youtube

Become A Rideshare Driver In Your City Uber

Is Uber Eats Pass Worth It 7 Things You Should Know

9 Concepts You Must Know To Understand Uber Eats Taxes Complete Guide

How Much Do Uber Eats Drivers Make Ridester Com

/images/2019/09/23/ultimate_guide_to_earning_money_as_a_delivery-partner_with_uber_eats.jpg)

Ultimate Guide To Earning Money As A Delivery Person With Uber Eats 2022 Financebuzz

Uber Eats Rolls Out Confusing New Fees Here S What They Mean The Verge